Pitt Offers Roth After-tax 403(b) to Faculty, Staff

The Office of Human Resources is announcing the addition of a Defined Contribution Savings Program option known as the Roth After-tax 403(b). Originally introduced in 2000 as the Roth IRA, the Roth became a permanent tool in retirement planning as a result of a 2006 tax-law change. Working with both Vanguard and TIAA-CREF, Pitt’s benefits department will make the Roth available to faculty and staff participating in the Defined Contribution Savings Program, effective Oct. 1, 2008.

Faculty and staff contributions to the savings plan are typically deducted from base pay on a federal pretax basis. Taking deductions on a pretax basis has certain advantages; most notably, pretax deductions reduce federal taxable income, thereby lessening the impact on take-home pay because participants pay less tax. The “downside” to pretax deductions is that contributions and their earnings are taxed when the participant begins to receive retirement income. In most cases, the impact of this taxation is softened because earned income in retirement may be less; therefore the tax basis may be lower.

With the availability of the Roth, participants can create more diversity in the taxation of their portfolios upon retirement. Roth 403(b) contributions are taken on an after-tax basis. This means that more income is taxed upfront; therefore, take-home pay is less. But withdrawals of contributions are not taxable, and the unique advantage of the Roth 403(b) is this: Earnings attributable to Roth 403(b) contributions may be withdrawn “tax free” in a qualified distribution. A tax- free or “qualified” distribution may occur when the withdrawal is made after attainment of age 59½ and completion of the Roth five-year seasoning period.

Information on the Roth After-tax 403(b) is being mailed to faculty and staff members’ homes and will include TIAA-CREF and Vanguard brochures. General guidance is also provided on who may benefit the most from making Roth After-tax 403(b) contributions.

Faculty and staff may choose not to take any action, make a change for Oct. 1, or defer any change to a later date.

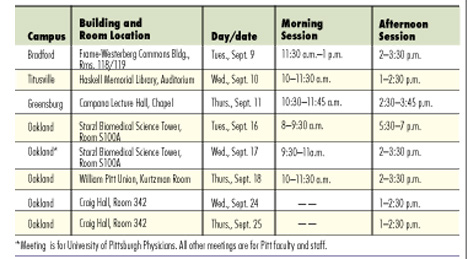

The benefits department, along with representatives from TIAA-CREF and Vanguard, will conduct meetings on all campuses in September. The presentation also will be recorded and placed online at www.hr.pitt.edu/Roth. Meeting times and locations for faculty and staff are listed below.

Other Stories From This Issue

On the Freedom Road

Follow a group of Pitt students on the Returning to the Roots of Civil Rights bus tour, a nine-day, 2,300-mile journey crisscrossing five states.

Day 1: The Awakening

Day 2: Deep Impressions

Day 3: Music, Montgomery, and More

Day 4: Looking Back, Looking Forward

Day 5: Learning to Remember

Day 6: The Mountaintop

Day 7: Slavery and Beyond

Day 8: Lessons to Bring Home

Day 9: Final Lessons